With the first half of 2022 now behind us, it’s time for our annual Century 21 Prospect Realty mid-year review!

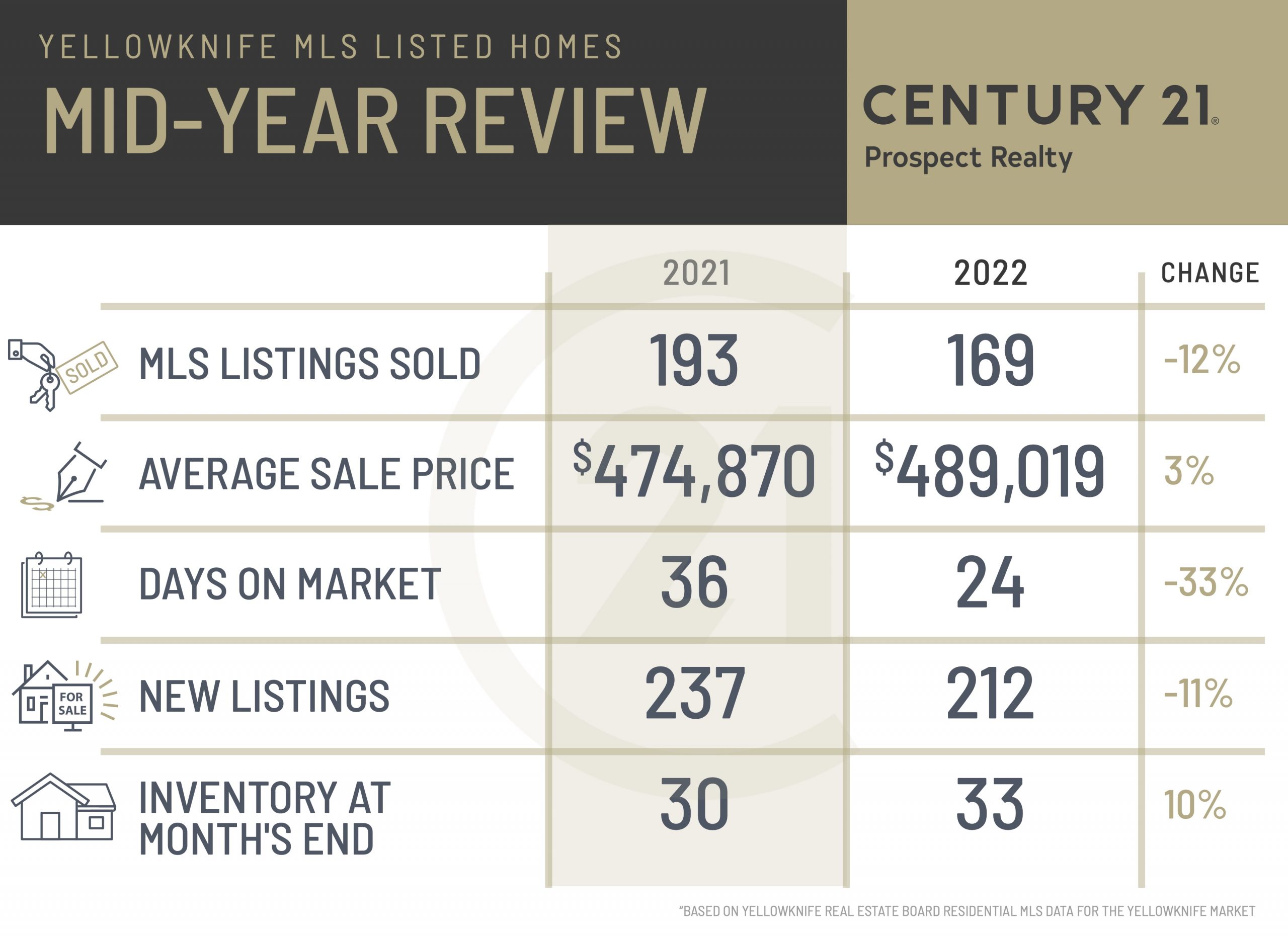

The 2022 Yellowknife real estate market has been very busy so far. Although this year’s 169 MLS sales represents a 12% drop from the first half of 2021, it was well above the five-year moving average of 139 transactions. To put things in perspective we had only 113 sales in the first half of 2017 and 114 in 2018.

Homes are selling even more quickly than last year, with the average days on market dropping to 24 from 36. The average home price has edged up slightly to $489,019. Inventory is ever-so-slightly higher by three listings, but for all intents and purposes, from a supply perspective, we have been scraping along the bottom for a year and a half now.

Homes are selling even more quickly than last year, with the average days on market dropping to 24 from 36. The average home price has edged up slightly to $489,019. Inventory is ever-so-slightly higher by three listings, but for all intents and purposes, from a supply perspective, we have been scraping along the bottom for a year and a half now.

What is most interesting this year is the lower number of listings coming to market (see chart below). We are down 11% from last year and we are also below the five-year average. The question is why? It is clear that homes that come to market and which are carefully priced are selling very quickly and profitably, so on the one had it seems odd that more people aren’t selling. But on the other hand, for people to sell a house, they have to buy another house to move into – either here or elsewhere. And the market both here and (especially) elsewhere in Canada has been pretty crazy for the last two years, so it may be that people are adopting a wait-and-see approach; especially now that interest rates are rising and the “R” word is gracing newspaper headlines almost daily. In Yellowknife, we have always been somewhat buffered from recessions and downturns, thanks to our high percentage of public sector employment, but it still impacts consumer sentiment. And perhaps more importantly, folks may be holding out hope that a slowdown will have a bigger impact on housing markets to which they may be hoping to move. Perhaps prices will come down in those places and more Yellowknife listings will come to market. Intriguing possibility, but we probably won’t find out until next year.

The June numbers also deserve a couple of comments. Although our method of calculating the average home price is a bit susceptible to being skewed by outliers in months like January and February, when sales volume is low, we usually don’t see the same problem in a month like June with 50 sales. And the average sale price this June jumped 8% to $522,216. In some of the hottest markets in Canada, prices have started to drop, but we’re not seeing that here.

The June numbers also deserve a couple of comments. Although our method of calculating the average home price is a bit susceptible to being skewed by outliers in months like January and February, when sales volume is low, we usually don’t see the same problem in a month like June with 50 sales. And the average sale price this June jumped 8% to $522,216. In some of the hottest markets in Canada, prices have started to drop, but we’re not seeing that here.

It will be very interesting to see if we start to separate from the rest of the country in the coming months. We’ll be watching this closely.

There is one other statistic that deserves mention, and it is not one that we typically comment on in these articles. The average price of lumber has dropped 62% since the pandemic peak in May of 2021. In most markets as hot as ours, rising resale prices and declining lumber prices would lead some frustrated buyers to consider the obvious alternative to buying an existing home – building a new home. But in Yellowknife, we have exactly one residential lot for sale through the City. That’s not a typo, you can find it for yourself on this page. Buyers in Yellowknife simply do not have the option of building new homes. Besides driving up prices of existing homes, this state of affairs is a missed opportunity for population growth and is really hard on the construction sector. And although new homes tend to be expensive, when people build new homes they sell their older, lower-priced homes, adding desperately needed supply of homes to the market. A lack of new lots for sale may be a good thing for people who are selling their homes and moving south, but for our community as a whole it is arguably unhealthy.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link