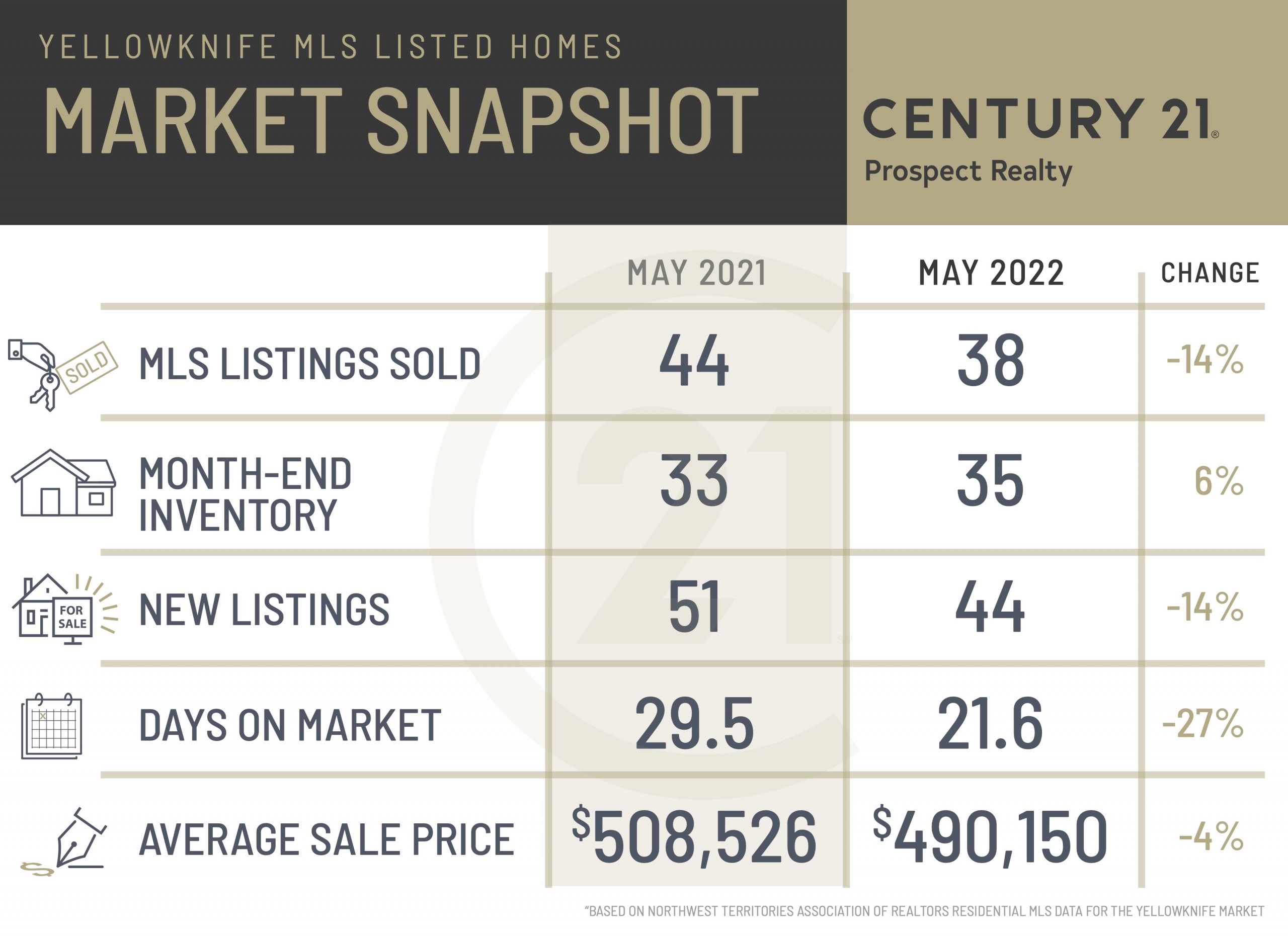

It has been a long while since we’ve seen month-end inventory higher than it was a year ago, but that’s exactly what we experienced at the end of May. A difference of two listings may not seem like a lot (35 listings on the market at the end of May 2022 vs. 33 in May 2021), but it’s still significant to have an inventory build-up of any kind after so many months of declines. Does this mean the market is on its way to a more balanced state? Usually we try to stay away from such prognostications, but there are a couple of reasons why it’s a pretty safe prediction right now.

First, the market is slowing down right across the country and, for the most part, as goes the nation, so goes Yellowknife. The April 13th interest rate increase by the Bank of Canada had the intended impact, and it’s safe to say the June 1st increase will as well. And according to the BoC there are likely a few more increases yet to come. So we know the market is slowing – it’s just a matter of time before we see evidence of the slowdown here in YK.

Secondly, although there are several construction projects that are soaking up rental units and the odd resale listing in town right now, we don’t have any significant long-term sources of economic growth driving demand. And with the “big shift” to mobile working largely behind us and household expenses going up again, the factors that increased demand for the last two years are dropping off one by one.

Thirdly, although 2020 and 2021 were good years for the Yellowknife real estate market, we didn’t come close to the levels of price appreciation experienced in most provinces. Our average home price increased last year by 8%, but the average across the country was 26%. So, since we didn’t deviate that far from a “typical” Yellowknife market, it won’t take much to return to the norm.

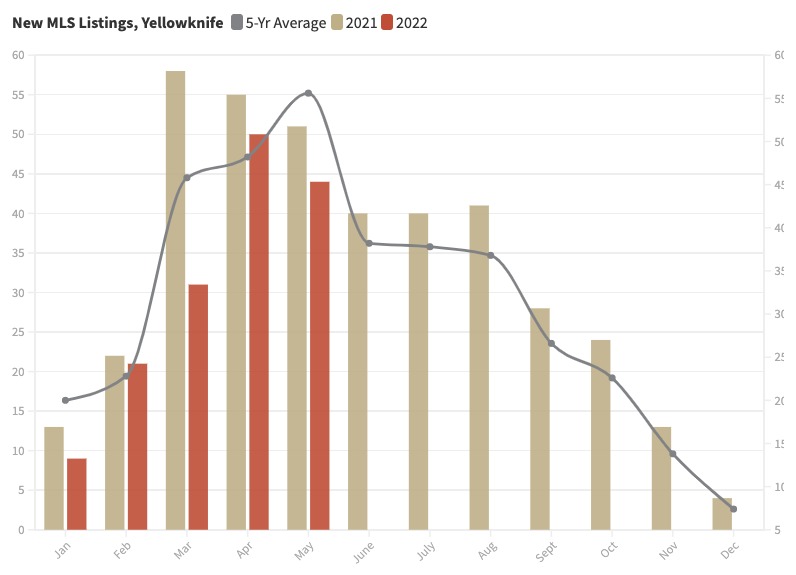

If there is one thing besides the aforementioned construction projects that is still keeping things tight, it is the slow pace of listings coming onto the market. As you can see from the graph below, we are well below last year and a bit below our five-year average. It’s tough to say why fewer people are listing their homes this year, but the relatively high price of real estate in the rest of the country might have something to do with it. Folks may be opting to stay put rather than taking that job in Ontario or buying that retirement property on Vancouver Island.

What does this all mean for homeowners? For those thinking of selling, there is a pretty good chance listings in 2023 will have a lot more competition than they have had since 2020. And beyond 2023, with Ekati scaling back in 2024 and Diavik closing in 2025, the trend towards a balanced market will likely continue. So make sure to get your home as close to turn key as you can in the coming year, put some extra effort into your yard work, and don’t forget to sign up for our free Summer Photo Promotion. Yellowknife homes have sold like hotcakes since 2020, but the bake sale may be approaching its end.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link