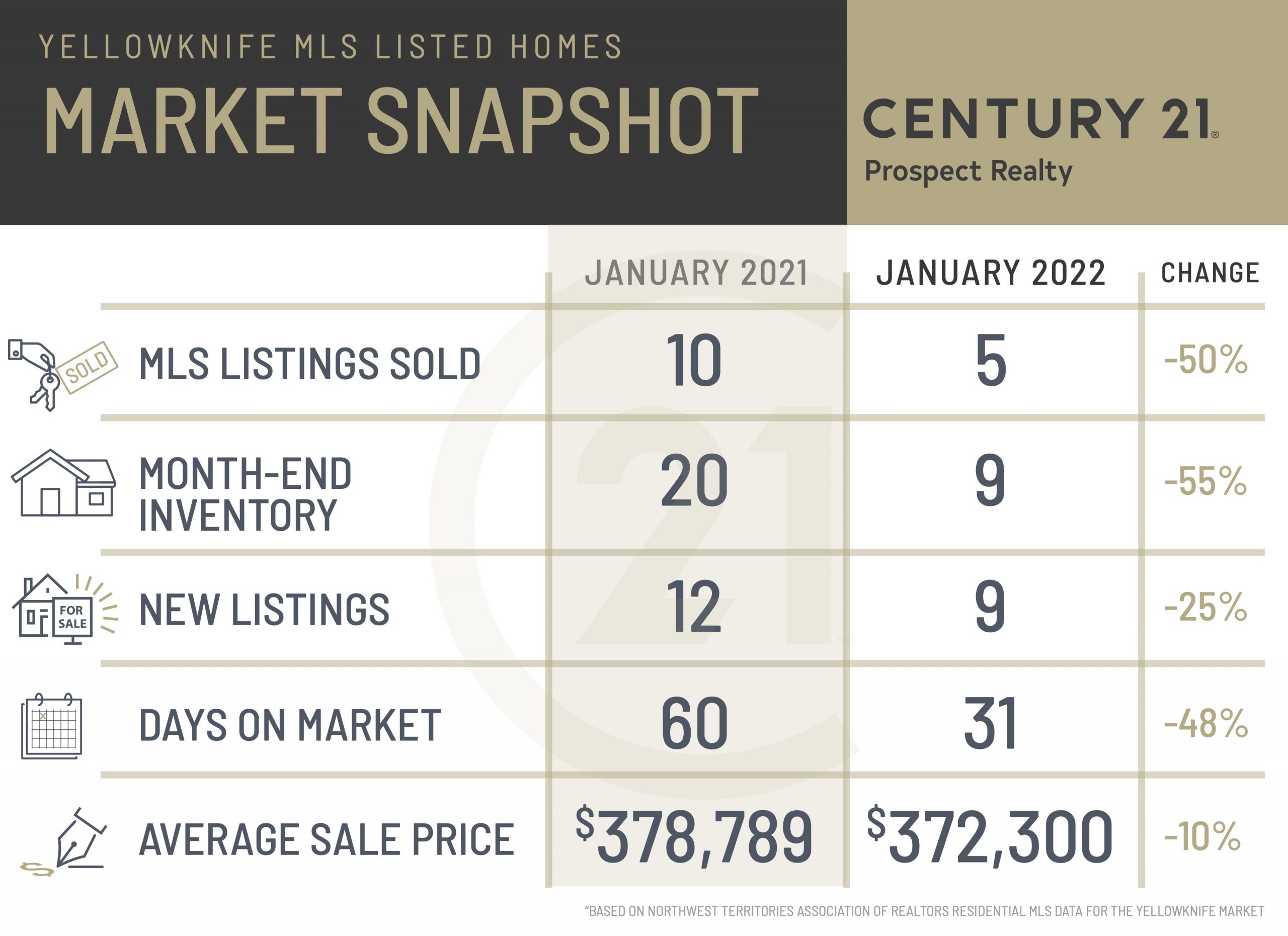

Because it is typically such a slow month, there is only so much that can be gleaned about the state of the Yellowknife real estate market by looking at January sales. To see what we mean by this, consider January’s average sale price of $372,300, a decline of 19% compared to the 2021 full-year average of $457,235. But this is misleading – the five homes that sold in the month just happened to be smaller (three condos, one modular, one townhouse). If you were to look at the sale prices of those five individual homes and compare apples to apples, you would see that we are still pretty much on the same price increase trajectory as last year.

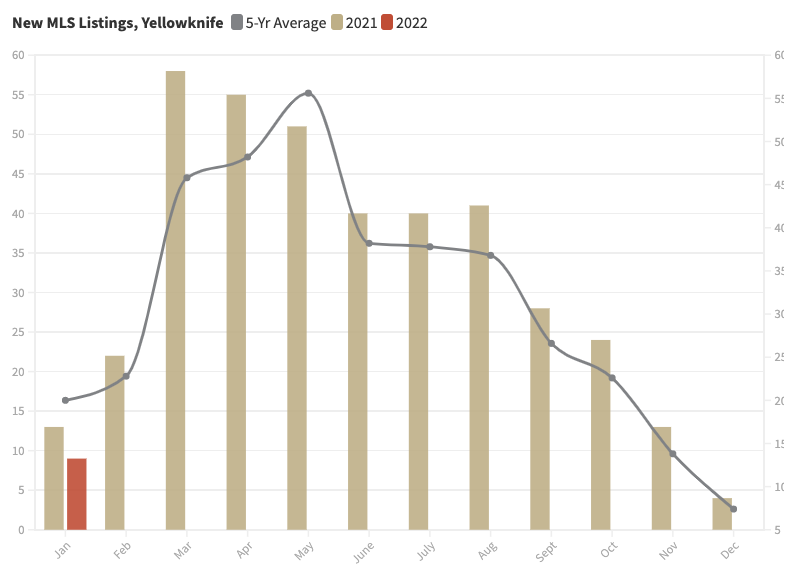

What is most interesting about January is that, despite the record low inventory levels, only nine homeowners chose to bring their homes to market. That’s unusually low, even for January. The chart below is a new feature that we’ll be including from now on in these monthly updates. It indicates how many homes were brought to market in the prior month, the prior year, as well as to the five-year average.

And what can we say about month-end inventory? If anyone had the bad luck of having to conduct a house-hunting trip to Yellowknife in January, it would have been pretty frustrating. There were nine listings on the market at month end and that number remains the same this morning. So, members of the Canadian Armed Forces and RCMP who are expecting to plan Yellowknife HHTs this year should pay close attention to the chart above. Last year March was our peak month for new listings, but over the last five years the peak has occurred in May. Our HHT Concierge, Kelly Vos, would be happy to provide more info and advice for anyone with an upcoming HHT.

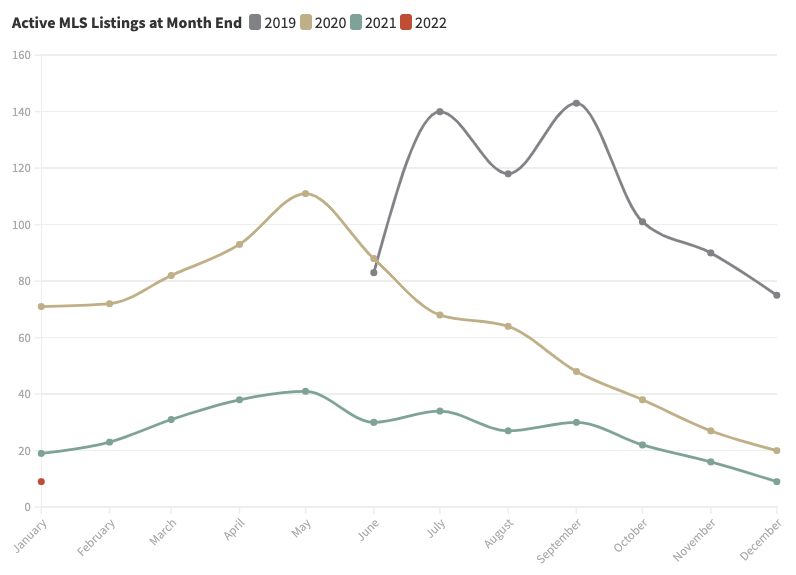

And lastly, below is our monthly chart of month-end inventory levels. Also very useful for HHT planning. We don’t have reliable numbers any earlier than June of 2019, but for the last two years, as you can see, peak inventory has occurred in May. And generally speaking, there has been a massive decrease in inventory over the last three years.

What does it all mean? For buyers, these are trying times. But for sellers, opportunities abound for selling at peak price. We have already seen several multiple-offer situations so far this year we expect many more to come. And “escalation clauses,” have become the norm in most of these situations (to the point where they are almost no longer useful – more on this in an upcoming post). So, whether you are selling or buying, make sure you are working with someone who is up to date on all the latest strategies for navigating multiple-offer scenarios. Our team is up to date and ready to assist!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link